How a Formal Network Design Capability Can Help Medical Products Manufacturers Thrive (3 of 4)

July 29, 2016 By: Senior Management | Topics: Healthcare, Network StrategyOptions for Acquiring a Robust Network Design Capability

This series explores the overarching trends that are upending the healthcare supply chain; why a formal network design capability is becoming essential to medical products manufacturers’ competitiveness and growth; and how manufacturers can develop such a strategic capability to position themselves for success.

In the previous sections of the series, we discussed the three major trends impacting healthcare supply chains and essential activities for executing a network design. In this post we explore the options available to medical products manufacturers to acquire their own robust network design capability.

Part 3

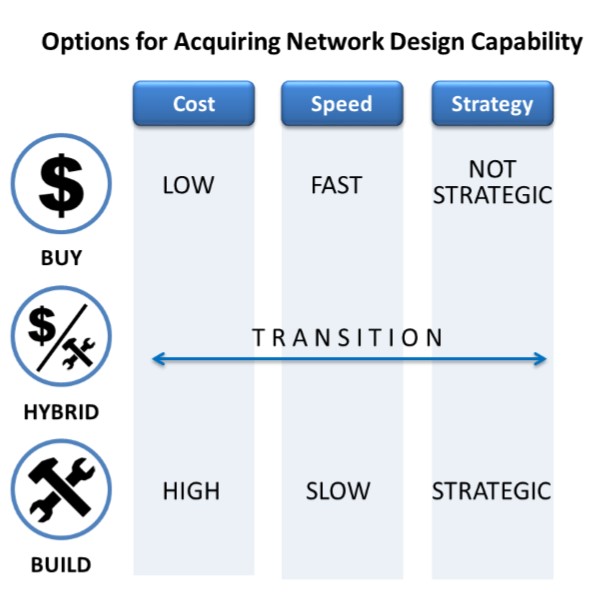

A formal network design capability is no small undertaking. The key process, tools and skills that underpin it take time, effort and money to create and maintain. When considering how to acquire such a capability, medical products manufacturers have three main options: buy, build, or something in between. The right course depends on a variety of forces.

Buy

In the classic “buy” approach, a company can decide to treat network design as discrete projects, defining each project and leveraging consultants and other third parties to help as projects emerge.

The advantage in buying is that the company doesn’t have to acquire the tools, hire and train the right people, and create the necessary processes to execute the project. This saves upfront time and money, as well as ongoing resources to maintain and enhance the capability over time. The “buy” approach also enables a company to benefit from the experience, best practices, fresh perspectives, and outside thinking of those who do network design for a living and have numerous successful projects under their belts. And the company has complete flexibility to use the capability (and pay for it) only when it’s needed. However, buying does not absolve the company from some investment in time and people, especially in the data collection phase.

On the other hand, the company doesn’t own the capability and, thus, is at the mercy of the third parties. This could mean the company isn’t able to mobilize as quickly as needed to capitalize on an opportunity when it arises, or that it can’t make important ongoing tweaks and refinements to its network design as it could if it had people in house skilled in and dedicated to it.

Hybrid

After using external resources for several initiatives, a company may determine that it could benefit from adding some network design resources to its own staff. It could, for instance, create a scaled-down in-house capability comprising mainly an analytics tool and small team to perform ongoing basic modeling. The company would then complement that team with external partners (including consultants and 3PLs) as needed to help with specific projects (such as rationalizing the networks after an acquisition).

The advantage of such a hybrid model is that the company avoids the significant expense and time associated with building a full-scale in-house capability, but does have some resources in place that can implement ongoing network refinements. It also then has the option to benefit from outside expertise and scale when projects require them.

The disadvantage is that a company loses some of the flexibility of the “buy” model while adding costs. And it may still not have a strong enough capability to do things on its own, especially a highly complex project requiring specialized expertise or one that must be executed quickly. In this case, a company still may find it needs to bring in a third party to help, which adds further costs to the model.

For these reasons, the hybrid approach makes the most sense as a transitional state. For instance, if a company historically has opted to buy the capability but knows it plans to be an aggressive acquirer in the next few years, it may find it valuable to hire some key talent to be involved in those strategic projects. When the acquisitions are over, the company could decide to either return to the buy model if the capability is no longer strategic; or, if it is, take the next step to build the model.

Build

Under the “build” model, a company creates a complete in-house capability (possibly in the form of a network design center of excellence) that enables it to quickly jump on any development (e.g., a new acquisition, a divestiture, a new product launch, or a new customer base) to analyze how it will affect the network design and identify any changes needed in response. The decision to build a capability is a highly strategic one. It signals network design is critically important to a company and, therefore, the process, models, tools and skills to do it effectively should be part of its supply chain strategic infrastructure.

Companies making the transition from the hybrid model have a head start: They can leverage the resources they have developed and the knowledge they have institutionalized to date as the foundation of their own in-house capability. This helps flatten the learning curve and gets the new capability up and running more quickly.

The downsides of the build approach are effort, time and money. Building and maintaining the in-house capability consumes a lot of all three and, if the capability is not consistently and effectively used, the return on that investment can be muted. It also can be difficult to find the right combination of subject matter, industry and analytical skills required to staff network design projects. And software can become obsolete over time as new tools emerge, requiring a company to keep tabs on the software market and upgrade when required.

The final installment of the series will examine how to decide between these options and make an effective selection.

Sedlak has been helping healthcare companies improve operations and optimize their supply chains since the 1960s. To learn more, contact us by filling out the form below.