How a Formal Network Design Capability Can Help Medical Products Manufacturers Thrive (1 of 4)

July 15, 2016 By: Senior Management | Topics: Healthcare, Network StrategyAt Least Three Trends are Reshaping the Healthcare Supply Chain

This series explores the overarching trends that are upending the healthcare supply chain; why a formal network design capability is becoming essential to medical products manufacturers’ competitiveness and growth; and how manufacturers can develop such a strategic capability to position themselves for success. In part one we will detail the trends which cause disruption in the healthcare supply chain.

Part 1

In most industries, a company’s supply chain is arguably the back-bone of the business. It’s what enables a manufacturer to get inputs from suppliers and finished goods to customers. And that’s why companies view any developments that disrupt the supply chain network as highly unwelcome.

Unfortunately, in today’s healthcare industry, disruption is the name of the game, and it’s affecting every player in significant ways. At least three over-arching industry trends are especially disruptive: mergers and acquisitions, the geographic dispersion of hospitals, and the internationalization of healthcare. They are rapidly changing the dynamics between medical products manufacturers and hospitals and, in the process, are roiling the broader healthcare supply chain.

Mergers and Acquisitions

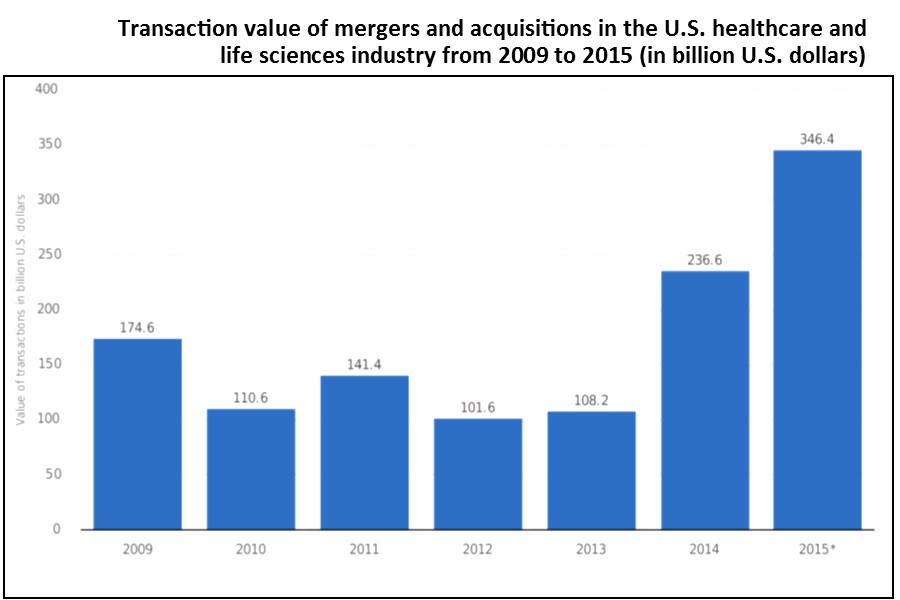

During the past few years, medical products manufacturers and hospital systems have been in a highly acquisitive mood, consummating hundreds of mergers or acquisitions during that time.

Manufacturers see such deals as a way to not only increase scale and reach but, more important, to close portfolio gaps so they can offer more complete solutions. However, to make those acquisitions work, manufacturers must rationalize the acquired company’s supply chain network with their own to optimize economies of scale and customer service. That can be a huge challenge, especially among larger companies.

Hospitals have been driven to consolidate by a desire to improve the quality of care provided while continuing to reduce costs to offset margin declines due to lower reimbursements. Yet as large health systems get bigger they, too, must rationalize their supply chain networks across their expanding foot-print to generate the benefits on which their deals were based. Many hospitals also see M&A as an opportunity to consolidate their spending, as well as improve their management of Physician Preference Items, to reduce product proliferation and costs. Regardless of how the deals play out, hospitals’ overriding focus on cost reduction means medical products manufacturers must serve hospitals more efficiently, which can have a significant impact on manufacturers’ supply chain networks.

Geographic Dispersion of Hospitals

In addition to merging, hospitals are spreading out with multiple specialized facilities in the same geographic area. This is a distinct departure from the traditional model, which was dominated by one very large central hospital. This geographic dispersion, combined with facilities’ need for more specialized products based on their area of focus, adds complexity to the overall supply chain network.

A good example is the ambulatory surgery center. As health systems strive to funnel more patients to ASCs instead of the more costly large hospitals, medical products manufacturers will have to deliver to more physical points across the hospital environment. With demand thus more dispersed, there are obvious implications for how a manufacturer distributes to those centers.

Furthermore, as the larger hospital systems continue to build their own infrastructure and capabilities to self-distribute to their facilities—Sisters of Mercy Health System’s ROI organization being a prominent example— medical products companies will need to adapt their approach to support this customer base. Rather than shipping through distributors, manufacturers now need to consider how to alter their supply chain to accommodate shipping larger volumes of product directly to a hospital-run distribution center.

Internationalization of Medical Products

As medical products manufacturers begin to look outside the U.S. for growth opportunities, many find it difficult to translate their costly U.S.-focused products to highly price-sensitive emerging markets. To help bring down their costs and make products more affordable, they are opening manufacturing facilities in those emerging markets—which further complicates their supply chain networks.

The reality is that as demand becomes more globally dispersed, the margin on those products declines, making net-work distribution costs—and, hence, network design—a critical concern. For more and more medical products manufacturers, the ability to understand the supply chain from a global perspective, and potentially analyze and model it globally, is becoming critical to their profitability and growth.

As a result of these trends, healthcare supply chains need to be capable and adjustable. In the next post, we will detail the strategic process of managing and executing network design on an ongoing basis for medical device manufacturers.

Sedlak has been helping healthcare companies since the 1960s to improve operations and optimize their supply chains. To learn more, contact us by filling out the form below.