Demystifying Freight Spend: How Shippers Can Get a Better Handle on Their Carriers (1 of 2)

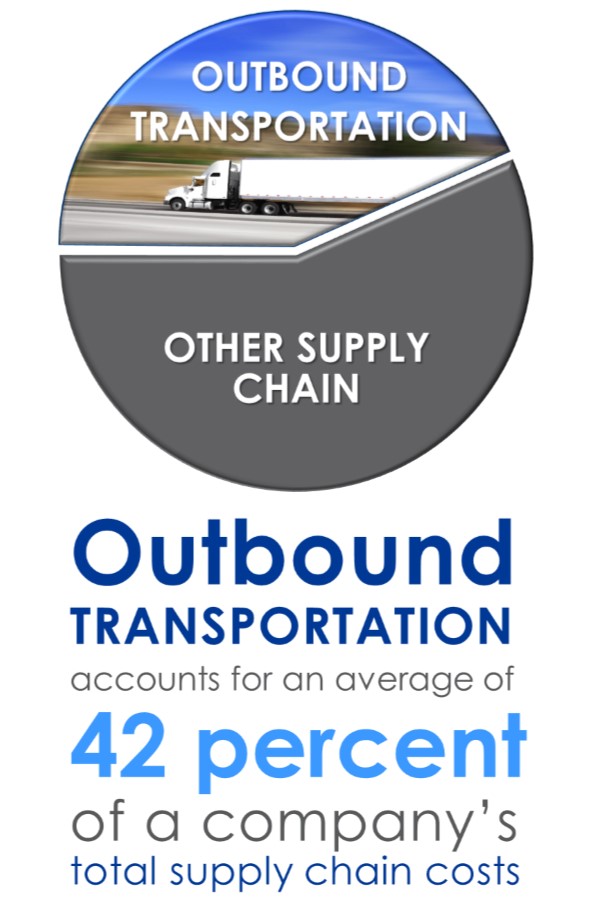

July 19, 2016 By: Senior Management | Topics: Transportation ManagementTransportation is a critical element of a company’s overall supply chain. It’s the linchpin for getting goods from Point A to Point B and, as such, plays a major role in keeping customers happy. But it’s also a major cost center. According to one study, outbound transportation accounts for an average of 42 percent of a company’s broader supply chain costs, while another study found transportation costs represent nearly 11 percent of sales at a typical $1 billion to $2 billion company. This makes effective management of transportation all the more critical to a company’s profitability.

One of the biggest drivers of transportation cost is what a company pays carriers to ship its goods—freight rates, fuel surcharges, carrier tariffs, and other associated fees. These expenditures are natural targets for companies looking to get a better handle on their transportation spend.

However, therein lies the challenge: Carriers’ rates and other charges can be incredibly complex, making it extremely difficult for a shipper to truly know what it’s paying carriers—and why. In fact, many shippers aren’t sure what’s actually included in their shipping contracts, which likely means a lot of money is going out the door that shouldn’t be.

How can shippers more effectively control freight spend? It starts with identifying some of the key pricing components of shipping contracts, which is the first step toward determining ways to reduce that spend.

Part 1 – Navigating the Pricing Labyrinth

Many factors can affect the price shippers pay carriers to move freight. The typical shipping contract includes five key pricing components: base rate, fuel surcharge, accessorials, freight classification, and tariffs.

Base Rate

Base rates vary by transportation mode. Ocean freight charges a flat rate by container, while air freight is always by the pound. Full truckload is usually based on mileage—whether a company is filling the truck with 40,000 pounds of steel bars or 40,000 packages of marshmallows, a carrier may offer to move a full truckload for $2 per mile with a $500 minimum. Less than Truckload (LTL) is based on weight, distance and classification of the freight (more on that in a moment). Small parcel (UPS, FedEx, etc.) is traditionally based on weight, volume, delivery time, and distance, with distances grouped by zones (though dimensional pricing is more the norm in parcel).

Many people think the base rate is the rate, but it’s really only the start of the pricing structure. Often the base rate makes up only 50 percent of what a company pays the carrier.

Last year’s changes in small package dim weight calculation by FedEx and UPS had significant impact on many shippers. Some prepared for it by reviewing packaging configurations—swapping carton cost for freight cost. Others were caught off guard when invoices came due. High-volume small-package shippers felt this change not only in freight costs but also back into DC operations.

Fuel Surcharge

A fuel surcharge is a fee carriers add to the base rate of a delivery to cover their costs for fluctuation of fuel expenses in the market. It’s usually tacked on to the freight charges on either a per-mile or percentage basis. Most fuel surcharges are based on an average mile per gallon and the current national average price of diesel. However, there isn’t a standard format used by all carriers. This is negotiable and can be tailored to an individual company’s circumstance.

Accessorials

Also called “value-added service charges,” accessorials are charges for performing services beyond normal pickup and delivery. These include multiple delivery attempts to the same address, delivery to a residential address on a business-to-business shipment, incorrect delivery address, lift gate requirement, inside delivery, waiting time, storage charges, and transporting hazardous materials.

Freight Classification

For LTL shipments, carriers want the highest load factors to achieve maximum efficiency. Thus, the National Motor Freight Traffic Association (NMFTA) has developed freight classifications for every commodity that can be moved on a truck based on four factors:

- Density: The weight per cubic foot.

- Freight Stowability: The length and width based on carrier mode rules.

- Ease of Handling: Evaluation of the care involved in transporting.

- Liability: This includes the freight price per pound, susceptibility to theft and damage, breakability, and perishability.

The NMFC guide is a very thick book that assigns a class to every commodity on a rating scale of 50 to 500. When a company ships LTL, the bill of lading includes the freight classes of all the items in the shipment. Carriers will weigh every shipment independently and cross-check it to the bill of lading. If there’s a discrepancy in the freight class—for instance, the bill of lading says the freight is class 55, but the scale says it’s really 150—the carrier will invoice the difference.

LTL carriers may also offer Freight of All Kinds (FAK) pricing, which is an arrangement between the carrier and shipper to allow multiple classes of freight to be shipped and billed at a single freight class. For example, a company that ships commodities ranging in class from 50 to 150 could negotiate an FAK to rate all items at class 100. The carrier doesn’t need to cross-check the weight of the shipment, and the shipper, on average, can achieve some cost savings on the higher-class shipments.

Tariffs

Tariffs are base rates unique to each carrier that are based on the density, weight, volume, and value of the goods being shipped. Tariffs differ by carrier by lane as an incentive to shippers to balance the carrier operations. Carriers issue tariffs each year, retain them seemingly forever, and also discount them across a broad spectrum. For example, one carrier may offer a customer an 85 percent discount on its 2015 tariff, but another carrier may offer 60 percent off its 2004 tariff. How can the shipper know which is the better deal? An 85 percent discount certainly sounds better than 60 percent, but given that base rates historically increase about 3 percent a year, an 11-year-old tariff might have a significantly lower base rate, which could make it the better deal, even at the lesser discount.

Ultimately, what all of this means for shippers is that it is exceedingly difficult to compare apples to apples when bidding out freight. So how can they navigate it? There are several ways.

The most obvious way is to do it themselves. A shipper can go to the carriers’ websites, input its freight class, origin, destination, weight and density (PCF, or pounds per cubic foot), and get a calculation of the cost to ship. Of course, doing that for every carrier and every shipment can be quite tedious, and for a large shipper moving a high volume of goods, impractical.

A more appealing option is to take advantage of rate bureaus. Rate bureaus will calculate averages of all the tariffs in a given year to identify an approximate cost for shipping under that year’s tariffs. Transportation analysis tools often contain a rate bureau and, more important, carriers can bid directly off these. This enables a shipper to get a true apples-to-apples comparison—for example, discounts of 75 percent versus 60 percent versus 85 percent off the 2015 average tariff.

Relying on expert analysts in the field can also be an effective approach. Such analysts have worked the rate labyrinth for many years and can provide a sophisticated analysis of all the rates, surcharges and discounts to help a company more effectively negotiate with carriers.

Finally, many shippers choose to work through companies that provide freight bill audit and payment services. Such providers will cross-check the invoices against the contracts and inform shippers when they’ve been invoiced incorrectly, which often can uncover significant opportunities to reclaim unwarranted payments. Through these providers shippers also can access all of their shipping data to understand their profile and shipping history, which can help them negotiate with carriers going forward.

In the next post, we will explore in more detail the rate hike that carriers experience and the ways to avoid this challenge.

Since 1958, Sedlak has provided independent and innovative logistics solutions to companies worldwide. Our logistics practice specializes in balancing transportation with other aspects of your business to achieve overall savings and service level benefits. To learn more about transportation optimization for your business, contact us by filling out the form below.